A thousand and one ways to protect your cryptocurrency like a pro

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

In the fast-paced world of digital assets, losing your cryptocurrency is easier than you might think. Forgetfulness, hardware failure, hacking, scams — the risks are real, and they’ve cost investors billions. But with a few smart precautions, you can drastically reduce the odds of your crypto disappearing into the void.

Why you shouldn’t leave your coins on an exchange

If you’re tempted to leave your holdings sitting in an online exchange account, think again. Every year, trading platforms are hacked, sometimes catastrophically. The infamous Mt. Gox breach saw 850,000 bitcoins vanish over several years before the exchange declared bankruptcy in 2014. And sometimes, your assets can be frozen overnight due to regulatory crackdowns, as happened in China in 2019.

The safest option is to control your own storage. That means protecting two critical pieces of information: your private key and your seed phrase. The private key authorises transactions, while the seed — typically a list of 12 or 24 words — lets you regenerate the private key if it’s lost. Lose both, and your crypto is gone forever.

Storing your seed phrase securely

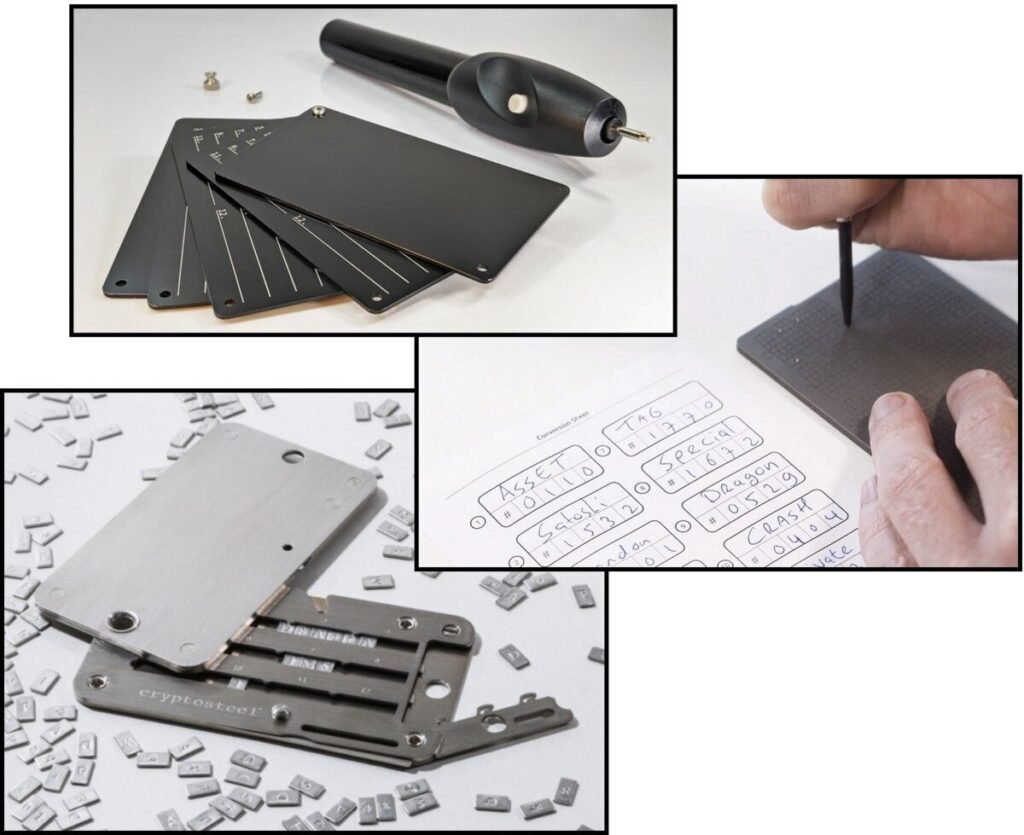

Your seed phrase should be a last resort — something you access only in emergencies. Never store it on a digital device, where it could be hacked or erased. Instead, write it down on physical media. Paper works, but metal is better: it’s resistant to fire, water, and corrosion.

Products like Crypto Steel, Cryptotag Zeus, or Crypto Keystack allow you to engrave or stamp your seed onto durable plates. Keep this backup somewhere secure but accessible — a home safe is good, a bank safety deposit box even better.

Keeping your private key offline

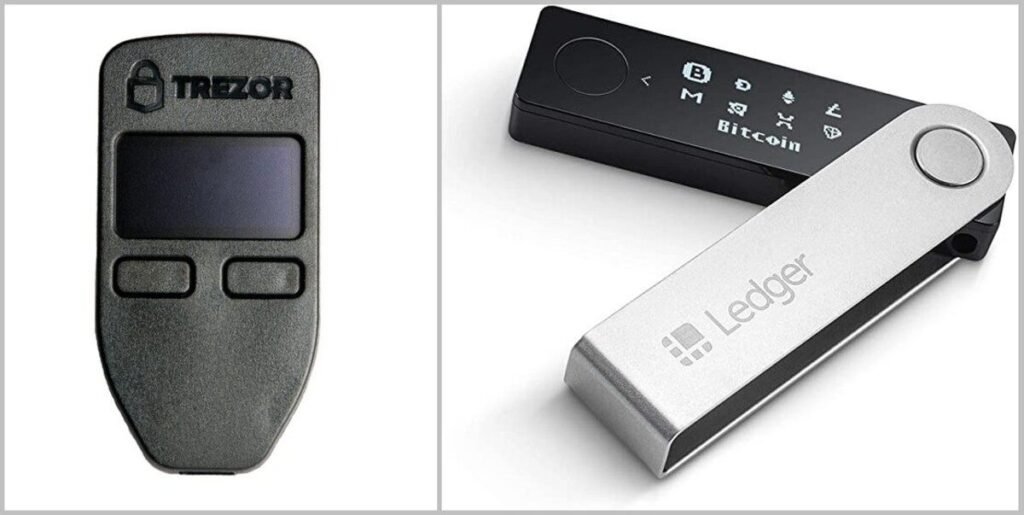

Your private key should never reside on a device connected to the internet. For long-term holdings, the gold standard is a hardware wallet from trusted brands like Ledger or Trezor. These devices store your private key in a tamper-resistant chip that never leaves the device.

You can monitor your balance using a “watch-only” wallet on your computer, which holds only your public key. When you want to make a transaction, you connect the hardware wallet via USB or Bluetooth; it signs the transaction internally before sending it back to your software wallet for broadcasting. Even if the device is stolen, it’s PIN-protected.

The low-cost option: a paper wallet

For pure cold storage, you can create a paper wallet. By generating keys offline — for example, using a tool like bitaddress.org on a computer disconnected from the internet — you can print your public and private keys as QR codes and store them securely. Just remember: there’s no seed phrase in this setup, so losing that paper means losing your crypto.

Knowledge is your best defence

Owning cryptocurrency isn’t just about buying coins — it’s about managing risk. Understand how keys work, learn the basics of cryptography, and decide on a security strategy before moving significant funds. The crypto market rewards boldness, but when it comes to security, it pays to be cautious and methodical.

Because in crypto, there’s no “forgot password” button — only what you’ve protected, and what you’ve lost forever.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |