Altcoins crash while Bitcoin stumbles: the cryptos to watch right now

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

Last week, Bitcoin briefly set a fresh all-time high above $124,000, only to tumble after U.S. inflation data (PPI) rattled markets. The world’s leading cryptocurrency has since slipped under the psychological $120,000 mark, raising fears it could test $111,000 next. Unsurprisingly, altcoins followed the downturn—Ethereum has fallen back below $4,500—leaving traders wondering which projects can hold strong in the turbulence.

Altcoin market cap clings to key support

Despite the pullback, the broader altcoin market cap has been in an uptrend since 2022, consistently forming higher lows and higher highs. A recent breakout above the long-term downtrend gave bulls fresh momentum, though the rally stalled before reaching a new all-time high.

At present, buyers still control the short- to medium-term outlook. The $1.5 trillion support level, combined with rising EMAs (9/18), could offer a lifeline for altcoins. However, a drop below this zone risks dragging the market back toward $1.2 trillion. Encouragingly, the RSI has been climbing since March, suggesting momentum remains bullish for now.

Bitcoin’s fall drags altcoins into the red

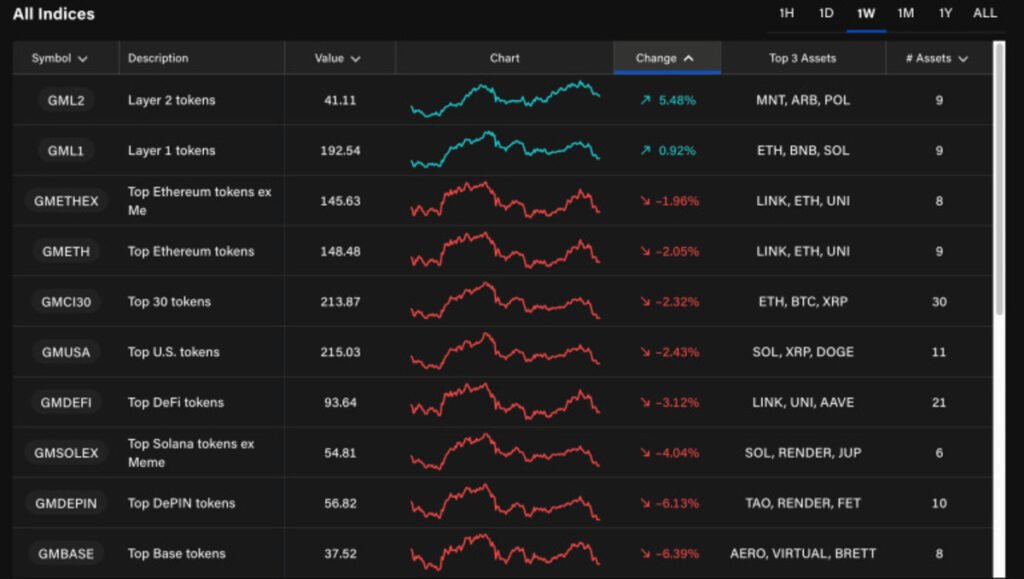

Bitcoin’s dip below $120,000 spilled over into altcoin markets, with most sectors posting losses over the past week. Data from The Block shows just two sectors managing gains: Layer 1 coins (up 1%) and Layer 2 solutions (up 5%).

Even Ethereum-linked tokens slid 2% despite ETH’s recent rally. The hardest hit? Memecoins, with Dogecoin leading a category-wide decline of more than 10%. Still, a handful of altcoins managed double-digit gains over seven days—proving that even in a downturn, some assets buck the trend.

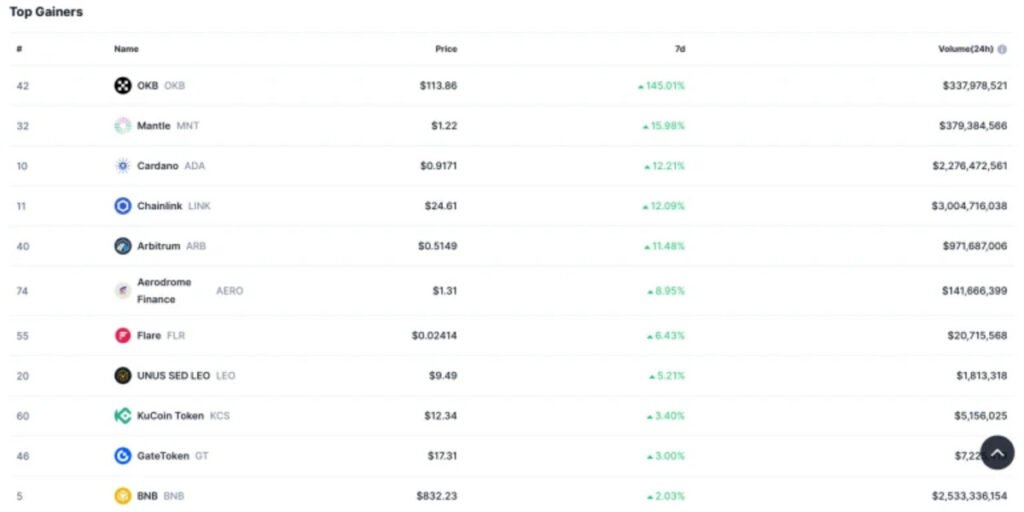

Among the winners: OKB surged an eye-popping 145%, while Mantle (MNT) rose 16% and Cardano (ADA) climbed 12%. Exchange-linked tokens like BNB, OKB, GateToken (GT), and KuCoin’s KCS were particularly resilient.

OKB smashes resistance and rockets past $160

After trading between $38 and $60 since early 2023, OKB exploded last week, breaking resistance and touching $160.

Momentum indicators like RSI remain bullish, but after such a vertical run, a pullback is possible. A retracement toward the $60 support or EMAs would be healthy, so traders should be cautious. As long as the token holds above $60, however, the long-term outlook remains positive.

Cardano (ADA) eyes $1.14 resistance

Cardano has been steadily climbing since its 2023 lows, forming a clear structure of higher highs and higher lows. Following a correction earlier this year, buyers stepped in strongly at $0.55.

ADA recently broke out of its $0.55–$0.80 range and is now targeting resistance at $1.14. If it fails to hold $0.80, the next stop could be back to $0.55. Momentum remains encouraging, with RSI trending higher since June.

Chainlink (LINK) faces a key test at $25

Chainlink mirrors ADA’s bullish structure, bouncing back strongly after its 2024 correction. The token is now pressing against the $25 resistance level.

A clean breakout would open the door to $34, surpassing last year’s highs. But if sellers push back here, LINK could drop to $17 support. For now, RSI suggests buyers still have the upper hand.

The big picture: crypto still tied to Bitcoin’s fate

The recent dip showed once again how tightly altcoins are tethered to Bitcoin’s swings. Still, bright spots remain: Layer 1 and Layer 2 projects are holding up, and exchange-linked tokens are showing surprising strength. OKB’s meteoric rise proves there are opportunities even in choppy waters.

Altcoin market cap may rebound if it holds $1.5 trillion, and if it does, some analysts see XRP as a potential breakout candidate—possibly eyeing the $10 mark.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |