Bitcoin’s future hangs in the balance — and Trump could tip the scale

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

Bitcoin has never been immune to politics, but right now its future may rest more than ever on one man: Donald Trump. Since returning to the White House, the former president holds the power to appoint the next chair of the Federal Reserve—an appointment that could shape not just U.S. monetary policy but also the trajectory of the world’s most famous cryptocurrency.

Disclaimer: The information below does not constitute investment advice. Always conduct your own research before investing and never risk money you cannot afford to lose.

A dovish Fed could spark a new rally

Traders have already been eyeing September as the month when the Fed may cut rates, potentially reigniting the appetite for riskier assets. But according to economist Alex Krüger, the true game-changer may lie in Trump’s pick for Jerome Powell’s successor. If he installs someone more aligned with his pro-growth agenda, the shift could mark the beginning of a new bull cycle for Bitcoin.

Remarkable how every time you get a correction from new highs so many people start to fret about the cycle top. Over and over again.

— Alex Krüger (@krugermacro) August 18, 2025

Some thoughts on the market:

– This indeed is not early in the move, bitcoin is already 7x from the 2022 lows, and much of the move recently is… pic.twitter.com/x9URFs7PqG

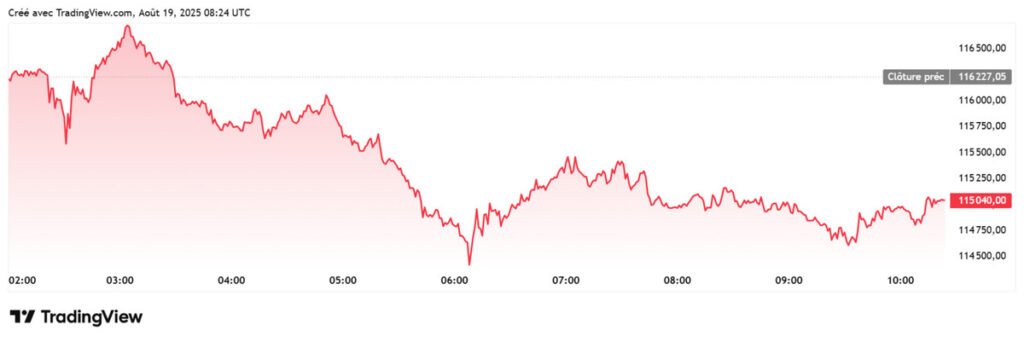

While Powell’s term officially runs until May 2026, Trump has not hidden his disdain for what he calls overly rigid monetary policy. Some of his allies are openly calling for a change sooner rather than later. Bitcoin, which briefly hit $124,000 before correcting to $115,000, could soar again if markets see the White House pushing for lasting monetary easing.

The shortlist for the Fed’s top job

Reports suggest that a shortlist of candidates is already circulating within Trump’s circle. Among the names: David Zervos of Jefferies, Rick Rieder of BlackRock, and former Fed governor Larry Lindsey. Sources say the list has narrowed to just a handful of contenders, raising the possibility of an announcement well before Powell’s official term ends.

This isn’t just a bureaucratic shuffle—it’s a decision that could reshape the monetary landscape for years and directly influence the flow of capital into crypto markets.

Monetary policy remains crypto’s referee

History shows that Fed rate cycles heavily influence Bitcoin. When borrowing costs rise, investors retreat to safer assets. When policy loosens, risk appetite surges—and Bitcoin has often been a prime beneficiary.

At the moment, CME’s FedWatch tool shows 83% of traders already expect a rate cut in September. But the real question is the long-term trajectory. If Trump appoints a Fed chair who embraces sustained easing, institutional players may pile in, making Bitcoin one of the biggest winners.

Money waiting on the sidelines

David Duong of Coinbase Institutional points out that enormous sums remain parked in money market funds, waiting for a clear policy signal. A pivot toward looser conditions could unleash those funds into risk assets, with crypto leading the charge.

For now, the market is caught between optimism and caution. Bitcoin’s recent pullback highlights just how sensitive it remains to political developments. Some traders view this as a prime entry point, while others are holding back until the Fed’s direction becomes clearer.

What’s undeniable is that Bitcoin has outgrown its early reputation as a self-contained, code-driven experiment. Its fate now moves in lockstep with Washington’s decisions—and today, it may rest squarely in the hands of one man: Donald Trump.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |