Everything you need to know about cryptocurrencies—Bitcoin, Ethereum, DAOs, ICOs, and smart contracts

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

Cryptocurrencies can sound intimidating at first — full of strange jargon, complex systems, and a reputation shaped by both innovation and controversy. But at their core, they’re built on a simple idea: enabling trust between people who don’t know each other without needing a middleman like a bank or notary.

Transactions are recorded in a shared public database called the blockchain, where users validate entries with cryptographic signatures. These validators, known as miners, are rewarded for their work in keeping the system secure and transparent.

Bitcoin: the pioneer of digital currency

Launched in 2009 by the mysterious Satoshi Nakamoto, Bitcoin was the first widely adopted cryptocurrency. It’s not a physical coin but a decentralised digital currency — no government or central bank controls it.

Bitcoin runs on blockchain technology, which can be thought of as an indestructible public ledger that anyone can read or write to, but no one can alter. This system is transparent, secure, and updated collaboratively by its network of users.

What Bitcoin can do

Like traditional money, Bitcoin can be used to buy goods and services — from repaying a friend to shopping online. Today, more retailers, both physical and digital, accept it as payment. There are even Bitcoin ATMs in various countries.

But its uses go beyond payments: it can secure online voting, certify academic degrees, or verify ownership in digital contracts. Its versatility has led to experimentation in countless fields.

Ethereum: more than just another cryptocurrency

Ethereum, launched in 2015 by Vitalik Buterin, is also a blockchain-based cryptocurrency — known as Ether (ETH) — but it introduced something new: the ability to create smart contracts.

These are self-executing agreements written directly into blockchain code. Once conditions are met, the contract triggers automatically. This enables decentralised applications ranging from fundraising platforms to supply chain tracking.

Why Ethereum matters alongside Bitcoin

Ethereum didn’t just copy Bitcoin — it extended its possibilities. The platform supports the creation of thousands of different tokens and decentralised apps. There are now over 1,000 active cryptocurrencies, each with its own purpose, rules, and user base.

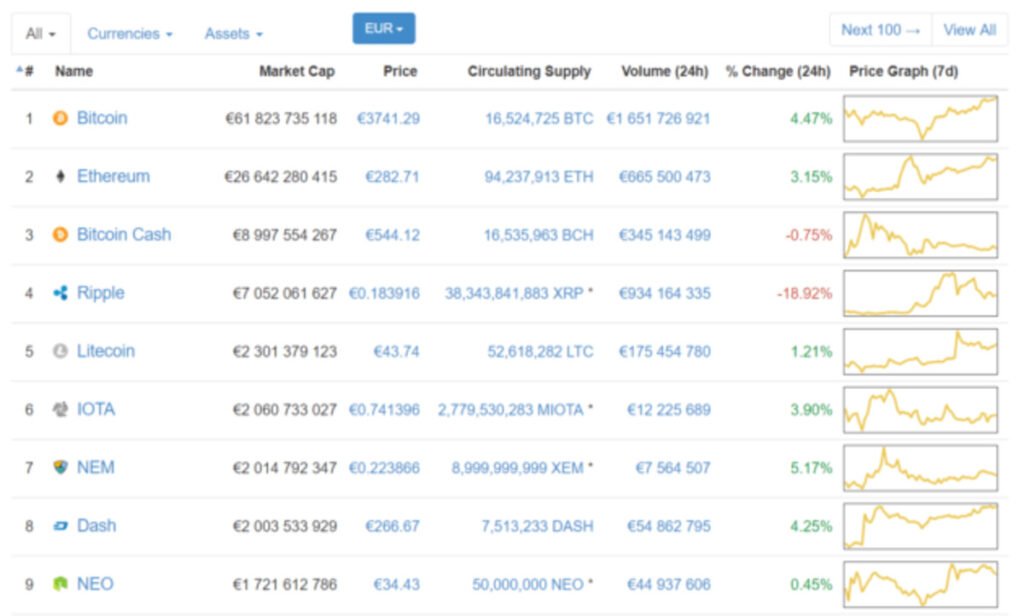

Where cryptocurrencies get their value

Crypto assets have a combined market capitalisation in the hundreds of billions of dollars. Bitcoin alone accounts for roughly half of that. A coin’s value depends on:

- Supply and demand dynamics

- Security and complexity of its blockchain

- Its real-world utility and ease of use

- Public and media perception

- Government regulation and legal clarity

Mining: how new coins are created

Mining is the process of validating transactions and adding them to the blockchain. Miners compete to solve cryptographic puzzles; the winner adds a block and earns new coins plus transaction fees. Due to rising difficulty, many miners join pools to combine their computing power and share rewards.

DAOs: decentralised organisations

A Decentralised Autonomous Organisation (DAO) runs on smart contracts instead of traditional management structures. The most famous early example, TheDAO, raised the equivalent of €150 million in 2016 before a vulnerability allowed an attacker to divert €60 million.

The Ethereum community controversially resolved this by hard-forking the blockchain — splitting it into today’s Ethereum (ETH) and Ethereum Classic (ETC). The incident highlighted both the promise and the risks of code-governed systems.

Smart contracts: automated agreements

Smart contracts act like digital “if-then” statements stored on the blockchain. Once the agreed conditions are met, the contract executes automatically and immutably. They are transparent, cost-effective, and resistant to tampering.

Applications range from supply chain automation to peer-to-peer insurance. While Ethereum remains the leading platform for them, other blockchains are starting to adopt similar features.

ICOs: crowdfunding the crypto way

An Initial Coin Offering (ICO) is a way for blockchain projects to raise capital by selling tokens before a cryptocurrency launches publicly. Investors buy these tokens in the hope they’ll appreciate in value or grant access to a platform’s services.

ICOs have funded projects like Bancor (€130 million in 3 hours) and Brave (€35 million in 30 seconds), but they’ve also attracted scams. A credible ICO typically publishes a white paper outlining the project’s goals, team, and token mechanics.

The takeaway

Cryptocurrencies aren’t just digital money — they’re an evolving ecosystem of decentralised technologies with applications in finance, governance, and beyond. From Bitcoin’s payment network to Ethereum’s programmable contracts, from DAOs to ICOs, the space is full of innovation — but also risk.

Understanding the basics is the first step toward exploring it safely and effectively. And in the world of crypto, knowledge is your most valuable investment.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |