Here’s why Bitcoin might reach $200,000 to $300,000 by Christmas

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

As Bitcoin shatters its own price ceilings, some analysts say we’ve only seen the opening act of its parabolic ascent. A final leg could catapult BTC toward $300,000 by year-end.

Bitcoin set to smash records by Christmas?

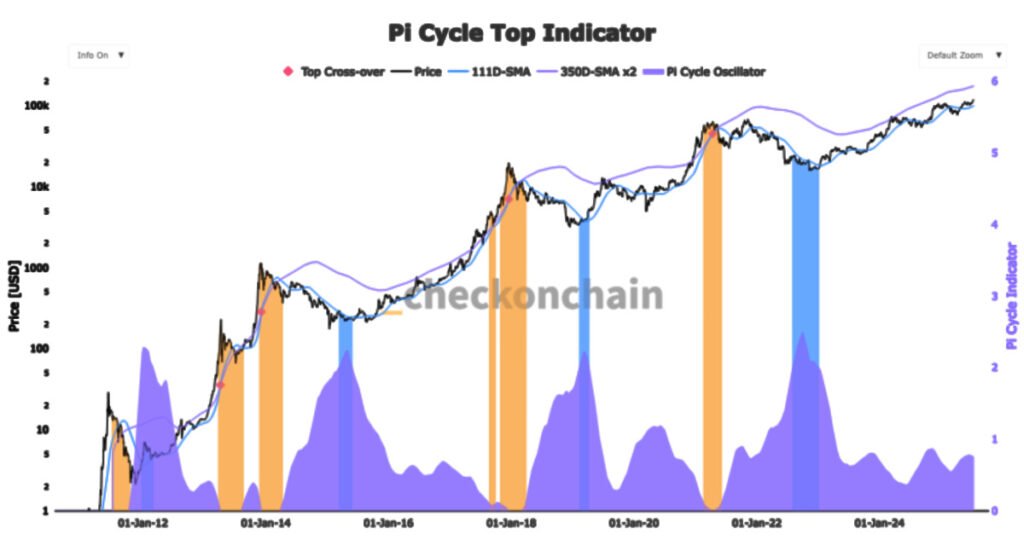

Bitcoin recently stormed past $122,500, sparking fresh excitement on trading floors and crypto forums alike. Analyst apsk32 argues that BTC’s price has followed a power law curve since its inception—each bullish cycle steeper than the last. I remember watching Bitcoin’s climb with a mix of scepticism and hope; back in 2017, a jump to $20,000 felt impossibly high. Today, that milestone seems quaint, as proponents forecast a stretch goal of $200,000–$300,000 before Christmas 2025. Even if the current price sits above the historical trendline—a classic late-cycle indicator—apks32 sees it as the opening bell of the “final parabolic phase,” advising cautious profit-taking along the way.

Institutional investors driving the rally

What’s really stoking Bitcoin’s furnace is the surge in institutional inflows. Big players now account for roughly 70% of new money flowing into Bitcoin ETFs, according to industry trackers. BlackRock’s IBIT fund alone amassed over $80 billion in 374 days, making it the fastest-growing ETF ever launched. Meanwhile, corporate titans like MicroStrategy have quietly hoarded nearly 600,000 BTC on their balance sheets. With retail investors largely on the sidelines, this tsunami of institutional demand could propel Bitcoin well above its 350-day moving average—projected around $172,000—setting the stage for an unprecedented year-end rally.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |