How to safely store your crypto and protect your Bitcoin with the right wallet

- Why Happiness Is the Real Currency—Better Than Any Crypto Investment - November 11, 2025

- How to start investing in cryptocurrency the smart way - September 1, 2025

- The 5 mistakes to avoid if you want to invest in crypto safely - August 31, 2025

If you’ve dipped your toes into the world of cryptocurrency, you’ve probably heard the golden rule: “Not your keys, not your coins.” In other words, keeping your Bitcoin, Ethereum, or any other digital asset safe means choosing the right wallet — because exchanges can be hacked, companies can collapse, and once your crypto is gone, it’s gone for good.

Hot wallets vs cold wallets

There are two main categories of crypto wallets: hot (online) and cold (offline).

Hot wallets — the kind offered by exchanges like Binance or Coinbase — are convenient. They’re easy to use, often free, and perfect if you trade regularly. But here’s the catch: your private keys are usually held by the provider, not you. That makes them custodial wallets. If the platform suffers a breach or financial trouble, your funds could be at risk.

Cold wallets, on the other hand, are offline. These “cold storage” solutions keep your assets away from the internet, making them far harder to hack. They can be non-custodial, meaning only you control the private keys. For anyone holding large amounts of crypto long-term, this is widely considered the safest option.

Hardware wallets: the gold standard

Among cold wallets, hardware wallets are king. These are physical devices, often resembling USB sticks, that store your private keys securely. Even if your computer is infected with malware, the keys remain safe on the device.

French company Ledger has become a global leader in this field, selling millions of wallets such as the Nano S Plus and Nano X. Prices range from around €79 to €149, depending on the model. Higher-end versions, like the Ledger Stax, feature sleek designs and even allow you to display your NFTs.

If you lose the device, you’re not doomed — recovery phrases (a string of 24 words given during setup) allow you to restore access. That’s why experts often recommend writing them down and storing them securely offline.

Paper wallets: simple but risky

Another offline method is the paper wallet — literally a printed sheet with your public and private keys. While it’s free and safe from online attacks, it’s highly impractical. If the paper is lost or damaged, your funds are irretrievable. It also doesn’t allow for easy spending without importing the keys into another wallet, which reintroduces risk.

Online wallets: fast and flexible

For everyday use, online wallets still have their place. Services like ZenGo strike a balance by offering a non-custodial setup: you hold your keys, while the app makes buying, storing, and trading crypto simple. Coinbase, meanwhile, is popular among institutional investors and claims to store 98% of funds offline for safety, but remains custodial.

The main advantage of hot wallets is speed. When markets swing, you can buy or sell instantly. With cold storage, you’d first need to transfer funds back to an exchange before making a trade. Many investors use both: hot wallets for quick moves, cold wallets for long-term security.

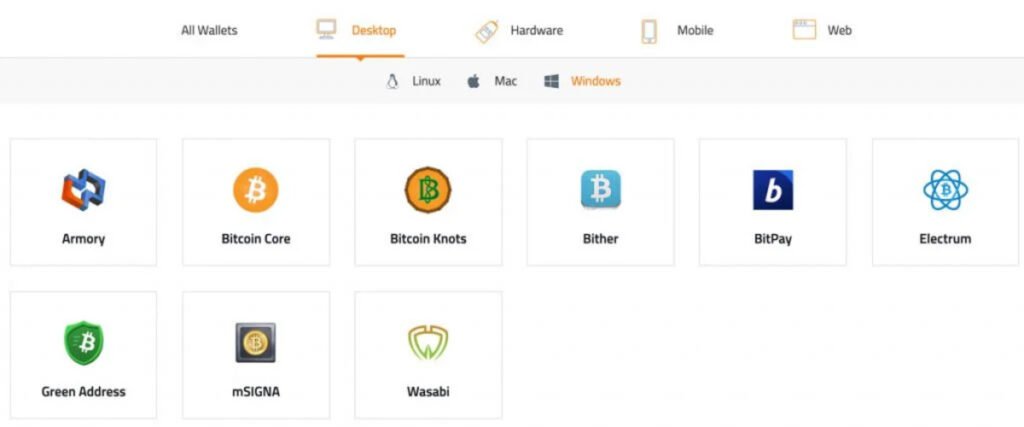

Desktop wallets: a middle ground

Desktop wallets store your keys directly on your computer. Open-source options exist, and they offer more control than hot wallets without requiring extra hardware. But they also come with vulnerabilities: if your device is hacked or infected, your crypto could be stolen. They also require regular updates, and in some cases, downloading entire blockchains to function properly.

The golden rule of private keys

Every crypto wallet comes down to two elements: your public address (like your bank account number, which you can share) and your private key (the password to access your funds, which must never be shared).

With custodial wallets, the provider controls your private key. With non-custodial wallets, you do. This difference is crucial: holding your own keys means true ownership of your assets.

Which wallet is right for you?

- Long-term investors: Hardware wallets like Ledger or Trezor are the safest bet.

- Active traders: Hot wallets on reputable exchanges are faster and more convenient.

- Everyday users: Hybrid solutions like ZenGo give flexibility without handing over control.

Ultimately, many seasoned investors use a combination: a cold wallet for the bulk of their holdings and a hot wallet for quick transactions.

In a market where fortunes can be lost with a single hack, one thing is clear: if you want to truly protect your Bitcoin and crypto, choosing the right wallet is just as important as choosing the right coin.

You may also like

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |